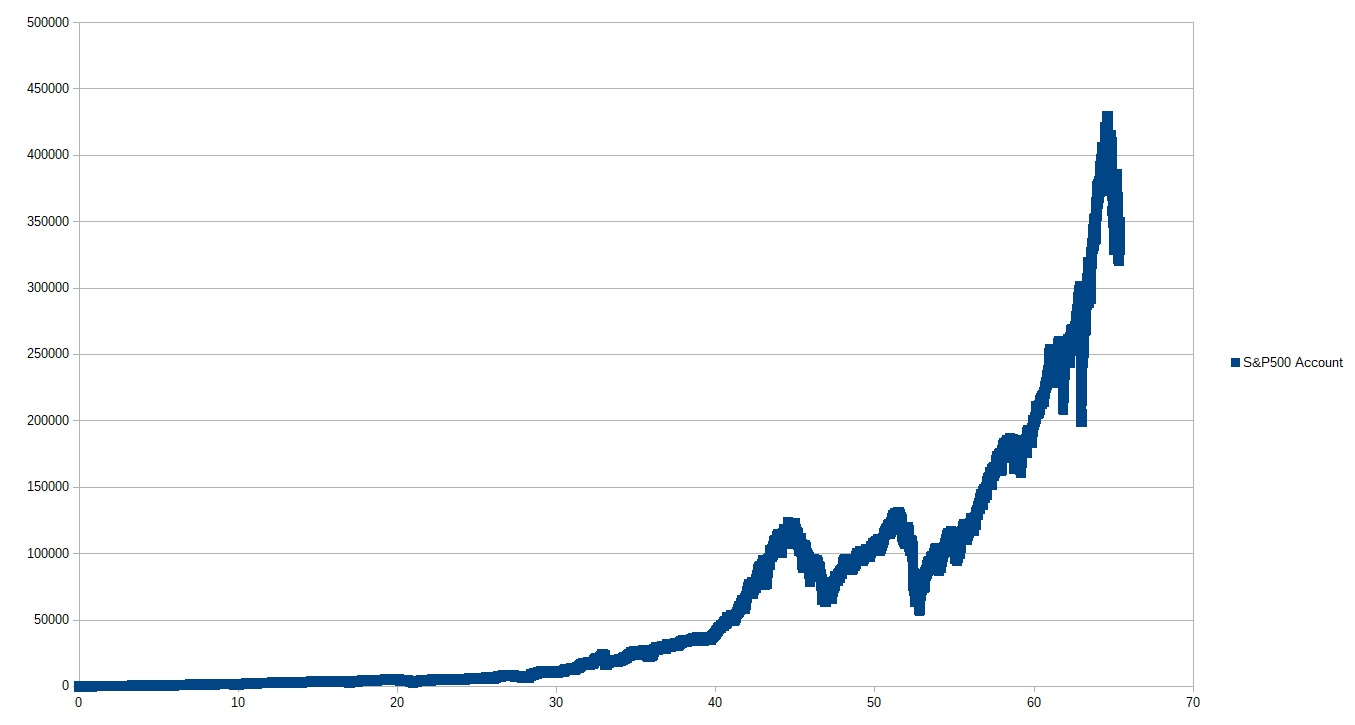

What if instead of spending money on the lottery, the same amount was invested in the stock market? Using data from the S&P500 index over the past 137 years, I was able to definitively answer that question.

To begin with, the average American consumer spends approximately $1000 per year on lottery tickets. That comes out to $3.66 per market day, assuming there are 273 such trading days in a year.

Using those figures as a starting point, I was first able to account for inflation, which stands at approximately 3.66% per year. That comes out to 0.01317% inflation per trading day, and 1238.57% over a 70-year span.

So then, assuming a person began investing in 1952, or 70 years ago, they would first start with a modest inflation-adjusted sum of $0.34865 per day, with each subsequent day's investment growing by 0.01317%, day after day, year after year, and decade after decade. The money already invested would then be subjected to the daily rise or fall in the S&P500 index fund's value.

The results were stunning to say the least. On any one day the S&P500 is either experiencing a bull or a bear market. But over 70 years, it has grown from a paltry $23.80 per share on January 2nd of 1952 to $3770.55 per share in November of 2022. And steady and consistent investment paid off immensely.

Just how much? Well, 17854 trading days after its first investment, the hypothetical account stood at $338,218.02 as of November 4th, 2022. That's in stark contrast to a probable account of $0 in the case of someone who had instead spent that money on the lottery.

The verdict is clear: a person is far better off putting their extra money in the stock market than they are spending it on lottery tickets.

Add new comment